Search

1/1

S$49.85

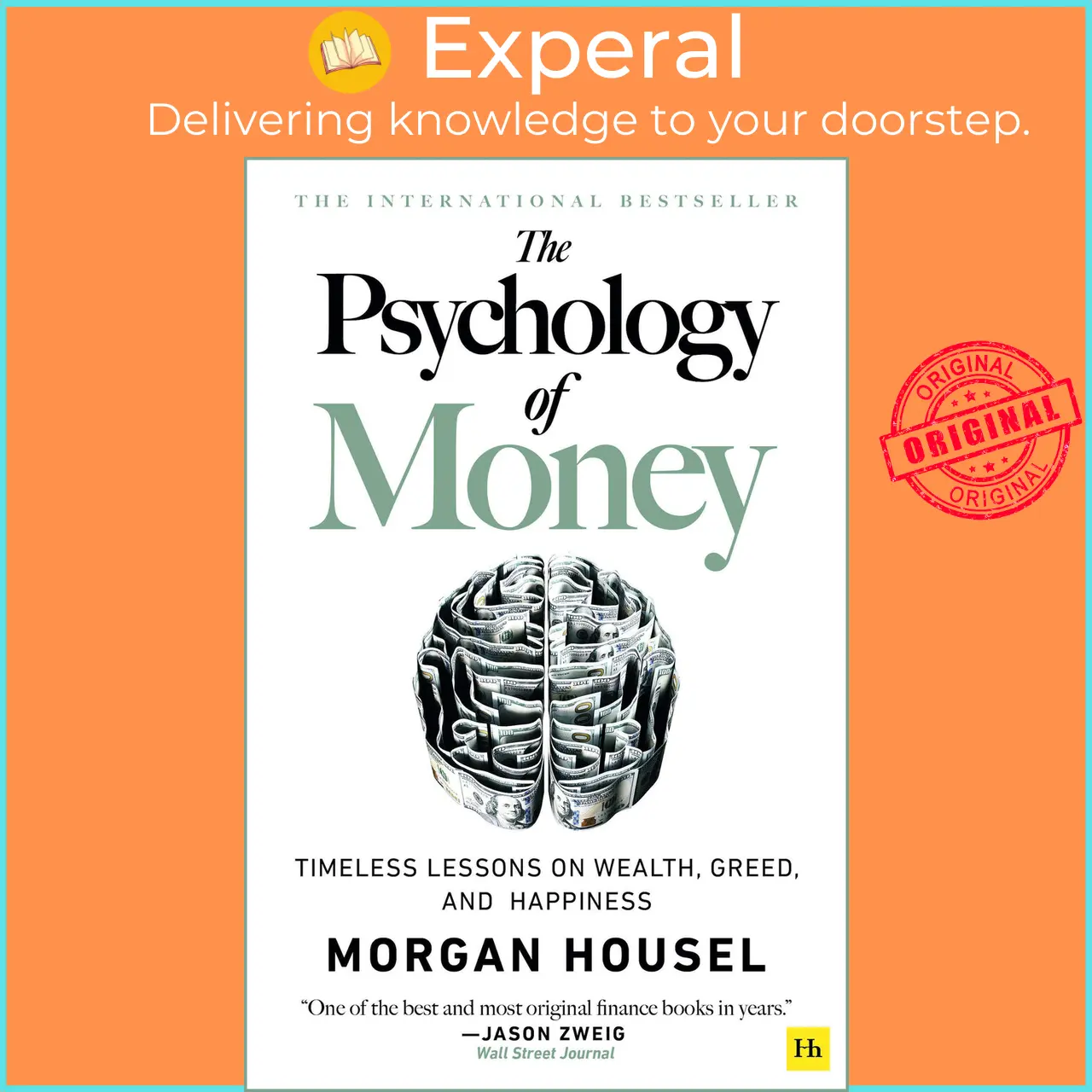

Forensic Accounting For Dummies by Frimette Kass-Shraibman (US edition, paperback) - 9780470889282

Sold by Experal Singapore

Select options

Default

Shipping

From S$1.99

Est. delivery by May 10 - May 12

Experal Singapore

9,160 items

Shop performance

Better than 66% of other shops

Ships within 2 days

65%

Product description

Ships from and sold by EXPERAL Singapore

Publisher: John Wiley & Sons

ISBN 13: 9780470889282

Condition: Brandnew

Binding: paperback

Pages: 384

Dimensons: 234 x 185 x 20 | 635 (gram)

----------------------------------------

A practical, hands-on guide to forensic accounting Careers in forensic accounting are hot-US News & World Report recently designated forensic accounting as one of the eight most secure career tracks in America., Forensic accountants work in most major accounting firms and demand for their services is growing with then increasing need for investigations of mergers and acquisitions, tax inquiries, and economic crime. In addition, forensic accountants perform specialized audits, and assist in all kinds of civil litigation, and are often involved in terrorist investigations. Forensic Accounting For Dummies will track to a course and explain the concepts and methods of forensic accounting. Covers everything a forensic accountant may face, from investigations of mergers and acquisitions to tax inquiries to economic crime What to do if you find or suspect financial fraud in your own organization Determining what is fraud and how to investigate Whether you're a student pursuing a career in forensic accounting or just want to understand how to detect and deal with financial fraud, Forensic Accounting For Dummies has you covered.Table of Content Introduction 1 Part I: Investigating Forensic Accounting 7 Chapter 1: Why the World Needs Forensic Accountants 9 Chapter 2: Steering Your Career toward Forensic Accounting 21 Chapter 3: Getting to Know the Most Common Fraud Schemes 33 Chapter 4: Forensic Accounting Minus the Fraud 51 Part II: The Anatomy of Occupational Fraud 67 Chapter 5: Cooked Books: Finding Financial Statement Fraud 69 Chapter 6: Investigating Inventory Fraud 83 Chapter 7: Examining Revenue Recognition Problems 93 Chapter 8: Studying Securities Fraud 107 Part III: It’s All in the Family: Fraud against Individuals 119 Chapter 9: Divorce with a Side of Fraud 121 Chapter 10: Protecting Estates, Trusts, and the Elderly 133 Chapter 11: Recognizing Real Estate Fraud 143 Part IV: Meeting Your Methods of Investigation 157 Chapter 12: Walking through the Investigation Process 159 Chapter 13: Tracing the Flow of Money 171 Chapter 14: Going to the Source: Obtaining Records 183 Chapter 15: Tapping into Electronic Evidence 199 Chapter 16: Who Wants to Know? Reporting on Your Findings 213 Chapter 17: Preparing for Trial: Business Litigation 227 Chapter 18: Organizing Evidence and Serving as an Expert Witness 243 Chapter 19: Peeking Inside Federal Government Fraud Cases 255 Part V: Preventing Occupational Fraud 271 Chapter 20: Helping Small Businesses Prevent Fraud 273 Chapter 21: Assisting Larger Businesses with Fraud Prevention 289 Chapter 22: Keeping Employees Honest (and Happy) 305 Chapter 23: Applying Technology to Fraud Prevention 315 Part VI: The Part of Tens 329 Chapter 24: Ten Entertaining Portrayals of Fraud 331 Chapter 25: T

Similar items in this category

Explore more from Experal Singapore

![ori [Wiley] Ensic Accounting Dummies](https://p16-oec-va.ibyteimg.com/tos-maliva-i-o3syd03w52-us/5892d10239ac4f59a625d699f57a0a10~tplv-o3syd03w52-crop-webp:800:800.webp)

S$65.55

S$69.00

No more products

Open TikTok